Why Does Bitcoin’s Price Make Random, Sudden Downward Moves?

A common knock on bitcoin is that it is “too volatile.”

There is no denying that bitcoin is a volatile asset. Its price action supports this conclusion on nearly all time frames (including minute, hour, daily, and yearly).

However, volatility isn’t necessarily a bad thing. In fact, volatility creates opportunity.

Bitcoin Versus Bonds: Asymmetric Assets

Jack Bogle, the founder of Vanguard, popularized the idea of a “60-40 portfolio.” The 60-40 portfolio is the basic idea that passive investors looking to efficiently transfer wealth through time should diversify their assets into 60% stocks and 40% bonds.

If bitcoin’s performance over the last decade tells you anything, it should scream that the 60-40 portfolio is dead.

A Deep Dive into Bitcoin’s Contango

Currently, the spot price (market price for bitcoin on exchanges) trades lower than futures prices. The spread for the June futures contract is more than 25 percent annualized on most major exchanges.

This means that anyone can buy bitcoin and use that bitcoin as collateral to sell the June futures contract. This trade locks in a risk-free 6 percent USD-denominated return (more than 25 percent annualized) no matter where the price of bitcoin goes over the following months.

What Percentage of Wealth Stored in Stocks will Move into Bitcoin?

If you’ve been following potential bitcoin price targets, you know that many analysts expect bitcoin to completely consume or eat into portions of gold, money supply (M2), global fiat-denominated debt, stocks (equities) and real estate.

Valuing Companies Post-Hyperbitcoinization

Bitcoin will fundamentally change the way investors value companies.

Upgrading monetary technologies is a radical paradigm shift that will leave many financial “experts” confused. Our current monetary system, the US Dollar, is based entirely on an ever growing mountain of debt. In contrast, the Bitcoin monetary system is equity based with no counterparty risk and no dilution risk.

Bitcoin Sellers May Evaporate in 2021

Bitcoin has a preprogrammed algorithmic stock to flow ratio. The ratio is calculated by dividing the existing stock of bitcoin by the flow of bitcoin to be mined annually.

This concept was originally made popular by Saifedean Ammous, author of The Bitcoin Standard and later was analyzed quantitatively by PlanB who created the S2F and S2FX price models.

$1M BTC is Early— Bitcoin’s Scarcity Leads to Global Abundance

Let’s compare two vastly different monetary technologies. One is government fiat currency (USD) and the other is bitcoin.

One has an exponentially growing future supply, and the other has a fixed total supply. One is unpredictable and controlled by central bankers and politicians, and the other is predictable and controlled algorithmically by code and user consensus.

2021 Bitcoin Investment Research Report

Bitcoin, the decentralized digital money, was discovered January 3rd, 2009 by Satoshi Nakamoto, the pseudonymous developer(s) who pieced together the original source code. Satoshi mined the very first Bitcoin block and received 50 BTC for the work. After that, the decentralized crypto network was born, and it would begin to grow and spread throughout the world like a virus.

Bitcoin Cannot Be Replaced

Bitcoin is a revolutionary new type of asset, a digital asset. Before Bitcoin, this concept of a scarce digital asset with no counterparty risk did not exist. It was not possible to create a scarce purely digital asset, like a physical gold bar on the internet.

The Future of Real Estate under a Bitcoin Standard

We are in the early stages of a transition between two monetary systems, InFi and DeFi. No, I’m not talking about DeFi as in “Decentralized Finance”. I’m talking about InFi (Inflationary Finance) and DeFi (Deflationary Finance).

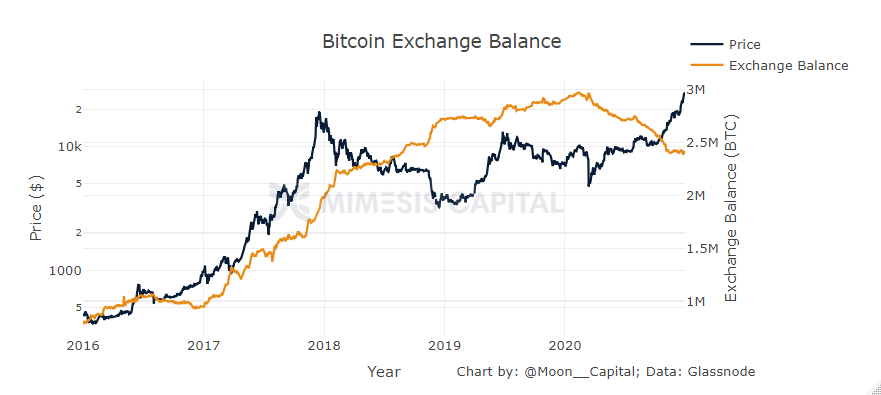

Unprecedented Amounts of Bitcoin Are Being Removed From Exchanges

Currently, there are roughly 18.6M Bitcoins that exist (maximum of 21M Bitcoins). Since March of 2020, when Covid fear reached its peak, lockdowns commenced all across the world, and markets collapsed, the number of Bitcoins held on exchanges has decreased at an unprecedented pace.

Is It “Too Late” To Buy Bitcoin?

Most people first hear about Bitcoin from its “NgU Technology” (Number Go Up Technology). Typically, Bitcoin’s never-ending parabolic price increases set off alarms for many intelligent people.

Should You Follow MicroStrategy & Use Debt to Buy Bitcoin?

MicroStrategy, the billion dollar publicly traded business intelligence software company became famous among the Bitcoin community after announcing it has adopted Bitcoin as their primary treasury reserve asset. Now it has taken its Bitcoin position one big step further.

Bitcoin and Generational Wealth

The topic of wealth preservation has not been more relevant than it is today. With the global economy being decimated for reasons known and unknown, it remains to be seen how families around the world will cope with the fact that their fortunes, often hard-earned across generations, may soon vanish. Is there a way to prevent it from happening?

Bitcoin — The World’s Safest Asset

Bitcoin is the most certain asset in the entire universe. It is an asset that has two unique characteristics that no other asset has combined.

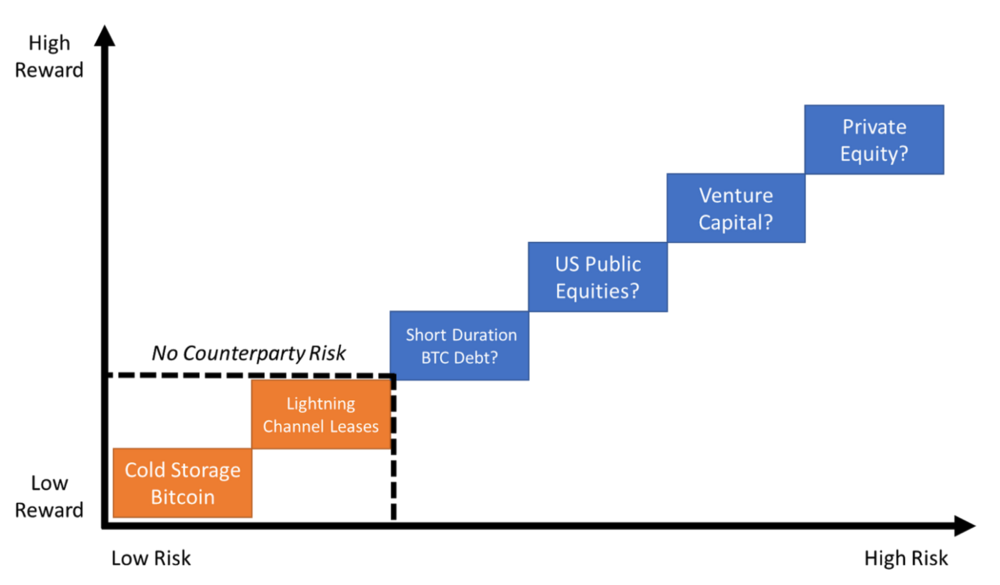

The Dawn of Bitcoin’s Yield Curve

The Bitcoin risk spectrum has two unique blocks as the foundation of this new financial system.